International fraud with fake websites, billing fraud, investment fraud and other scams where fraudsters elicit payment on an incorrect bank account number with victims living in other countries is unfortunately common. Our firm has handled dozens of such cases in recent years. In this blog, for victims who do not live in the Netherlands, we describe the options for recovering money if a Dutch bank account number is involved in the fraud.

What types of fraud are there

The imagination and creativity of scammers is endless, and the Internet has created limitless opportunities to commit fraud. Unfortunately, there is no gatekeeper to stop fraudsters from seeking victims with the help of the Internet. We have dealt with cases where a hacker spent some time reading business correspondence, then sent an invoice at the right time that made sense, but with the wrong number (CEO or invoice fraud). There are fake websites that sell or promise goods or services that are never delivered (advance fee fraud). There are cloned websites that look very similar to the website of real banks or licensed and reputable investment institutions, selling investments, while they are ghost companies, having fake accounts. Victims think they have bought investment products, but it is an illusion. These types of scams are sometimes very difficult to spot because existing names and logos are used (cloned). Not only individuals, small and large companies can also become victims.

Abuse of weak control over international payments

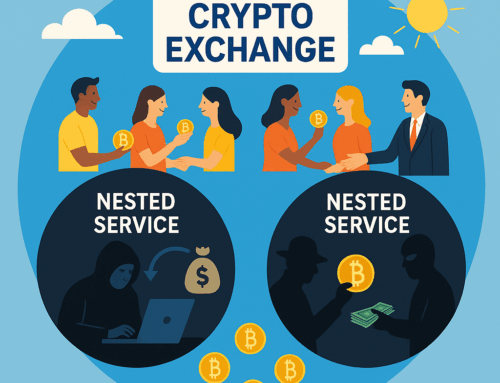

Scammers exploit the lack of name/number verification in international payments in these forms of fraud. In the Netherlands and in (many) other European countries, domestic payments are subject to prior verification that the bank account number and the account holder’s name match. If not, the payment is blocked, or the payer is alerted that the name and number do not match. This prevents fraud at the national level, but for cross-border payments, this control system does not yet exist, although it is being worked on. Payments across national borders are made based on the number alone, and thus the payment is not stopped if the bank account is in the name of another person, who has evil intentions. Fraudsters know this and take advantage of it. Therefore, this type of fraud is very often organized internationally by criminals from different countries working together. International fraud is difficult for police to combat because of the time it takes to request data in other countries.

The first step: report the fraud to your own bank and collect the details

If you are reading this Internet page, it will not be a coincidence: you apparently suspect that you are a victim of fraud, you have transferred money to a Dutch bank account number, and you are looking for more information. The first thing to do (if you haven’t already) is to contact your own bank, and report the fraud. Your own bank will then send a “Swift” message to the Dutch bank. In such a message, your bank may ask the bank where the payer’s account runs to investigate the transaction and request that the account be blocked so that the money cannot continue to be siphoned off. Sometimes (not always) such an action results in a sufficient balance (or a large portion) being blocked and reserved in time to compensate the loss. If you suspect fraud but are not yet sure, a “Swift” message is an important link. Almost always, the bank account is in the name of a different person than the name provided at the time of payment to whom you thought you were paying. A difference between the given name and the actual name can be verified and determined by the contact between the banks through Swift. If the bank account number is indeed in a different name, you will know for sure that you are dealing with fraud, if you still had any doubts. Even the bank cannot then deny that fraud has occurred. By the way, you will not be told whose name the account is in, you will only be told that the account is in a different name than you thought. But this does prove fraud. After all, you did not intend to pay to the account holder; you thought this account was in another name.

Second step: contact a lawyer

Many people think that if the fraud is known to the banks involved and if money is frozen via account blocking, the matter will settle itself. That is not true. You will have to take action yourself by hiring a specialized lawyer who will take the necessary measures to skim the blocked bank account and recover the money. In addition, if the account has not yet been blocked, you must take action yourself through your attorney (more on this below). It’s not like the police do this for you, especially in cross-border cases. International police cooperation likes to be slow, while speed is important: money can be moved quickly. It is also important to hire a lawyer in the country where the bank is located. The latter can request information and take action more quickly than the police because it knows the local procedures and the requirements of the banks. Furthermore, you should realize that the police are in the business of tracking down suspects, which is not the same as claiming damages. The latter is the work of lawyers.

Third step: collect the data and report to the police in your hometown

To properly handle your case, you do need to report it to your hometown police. The place where the victim lives is the logical place to report the crime. The declaration is part of the evidence needed for the civil suit. You should then send the declaration to your lawyer, in the original language. It may be that we later advise you to file a report with the Dutch police as well, because additional information has become available as a result of our work (such as the account holder’s name and address information). Please also include all relevant data, such as the fake invoice, emails, proof of payment, and so on. If fraudulent websites are involved, remember that they can disappear, and take screenshots so you can prove later that you were scammed through them. If you suspect hackers have been reading your emails, have your computer checked by a specialist, make a copy if necessary to secure evidence of viruses and malware, and change your passwords. You can also have an IT specialist investigate from which IP address unauthorized persons accessed your account (hackers usually use a VPN connection to stay hidden). If it involves a business relationship where hackers accessed the business associate’s email, notify that party. If it involves investment fraud, check the Internet to see if regulators have posted warnings mentioning the organization’s name.

Fourth step: the lawyer can now start a case

We now have the necessary data to take legal action. We first assess whether we are also convinced of fraud and we discuss with you whether the data is complete. If the Dutch bank has already frozen the account as a result of a fraud report, then on the face of it there is no need to impose a prejudgment attachment on the account. However, we usually recommend doing so because the account holder who received the money may have several other creditors who want to recover from the same balance. Creditors are equal in rank, but one creditor may choose to take quicker and more adequate action than another creditor, and so in theory, a creditor who takes adequate action may receive money while another creditor who takes a wait-and-see attitude receives nothing.

Seizure of bank account to secure balance and prevent hiding of loot

Prejudgment attachment of a bank account can be made in the Netherlands after a relatively short and simple procedure, in which the opposing party is not summoned and cannot present a defense. The attachment is made by surprise after permission from the court. The surprise effect is especially important if the bank account is still being used for fraud and there is still a balance, because the bank has not yet noticed that fraud has occurred; fraudulent use of bank accounts is sometimes noticed quickly, but sometimes not (for example, if international payments have taken place before, so that the fraud recognition system does not mark a transaction as unusual). In the Netherlands, an ordinary lawsuit must be filed against the debtor within 8 days after the garnishment is imposed, in which the validity of the claim is assessed. In practice, it is possible to get a longer term. This is also necessary in this situation because the account holder’s name and address are not yet known. The prejudgment attachment can be levied on the bank account without the name of the account holder being known, but in the follow-up procedure this person will have to be summoned; his name and address must still be known.

Obtaining the account holder’s name and address information

The next step is to request the unknown account holder’s name and address information from the bank. We send the necessary supporting documents to the bank’s fraud department and ask for disclosure of name and address information. Usually the bank itself first asks the account holder to return the money, and that almost never happens, because now it is fraud. Sometimes the account holder is willing to repay part of the loss if the account is frozen by the bank, but that is the exception. A court decision is almost always required. This decision is almost always in favor of the fraud victim. Obtaining name and address information usually takes about 4 weeks. After obtaining the data, we perform a number of checks to determine the identity and residence of the other party. Sometimes the information provided by the bank is out of date because someone has moved. Holders of Dutch bank accounts are almost always individuals living in the Netherlands, but there are exceptions to this as well.

The main procedure

The claim for reimbursement is usually brought through what is known as an interlocutory procedure after establishing the identity of the other party. Summary judgment is a quick trial that results in a result within about 2 months. The fraudsters usually fail to appear and do not raise a defense, although sometimes the fraudsters do appear and give a false reason to justify the payment, or raise other defenses. That defense almost never succeeds, provided the victim can prove that the payment was fraudulently induced. We have usually established that in advance, so the chances of the plaintiff being proven wrong are usually very small. In the Netherlands, in summary proceedings, the judge rules within 2 weeks of the hearing. It is not mandatory to be present at the hearing; we can represent you. In many courts in the Netherlands, it is possible to attend remotely via a video connection.

The enforcement

Enforcement means: collecting of payment awarded bu the court by measures taken by a bailiff. If the bank balance has been frozen by the bank, or if a prejudgment attachment has been placed, this balance will be retrieved by the bailiff and paid through. If balance is available, settlement takes 2 to 3 months. This is the most favorable scenario. In some cases, no attachment was made and no balance was frozen by the bank. In that case, the debtor must pay off the debt through his income or through forced sale of property. That path may take a long time, and is a less favorable scenario, but small partial payments per month is always better than nothing. Unfortunately, there are also cases where there is nothing to be gained from the debtor, for example, if the debtor has been declared bankrupt, faces a prison sentence or has disappeared. In some cases, however, we can still get results in other ways by finding out how the flow of money continues and taking action against other individuals involved in the fraud. The fraudulently received amounts may have been transferred to third parties, to other bank accounts. In the Netherlands, it is possible to request bank statements through separate proceedings against the bank. This then gives more insight into the individuals involved. Sometimes we combine these proceedings with the summary proceedings against the debtor. These other steps depend on a number of strategic assessments of the opportunities presented by the case. In this blog, we cannot discuss all the different variants. At the outset and as the case proceeds, we will make the necessary assessments and discuss with you the likelihood of success.