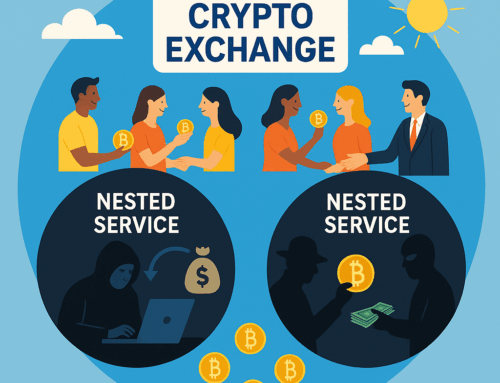

A money mule is a person who makes his checking account available to a criminal to receive and transfer criminal loot.

Cat catcher or money mule?

Another word for money mule is “cat catcher” (in Dutch), although this term is actually broader. The word cat catcher is also used for persons who transfer assets of criminals to their name, such as a car or a company. To the outside world it seems that the cat catcher is the owner. This usually concerns possessions that have been earned through criminal activities from the past. A money mule or money mule specifically concerns the lending of bank accounts by (temporarily) giving a debit card and/or internet banking login code to a criminal, often for a fee and sometimes under threat. The criminal offense then still has to be carried out: the criminal needs the money mule to defraud or rob one or more people, and to remain out of the picture as the perpetrator. Money mules are sometimes very young (pupils and students) and usually do not ask critical questions.

Criminal law

A money mule commits a criminal offense (money laundering). It does not matter that he or she does not know the identity of the victim and the size of the stolen amount (in advance), if you lend your bank card and/or login codes, you could already be convicted, because you can guess that your account is being abused. The chance that a money mule will be caught is quite high. That’s because the bank details of the money mule can be seen on the victim’s bank statement, who can file a report. It is therefore quite easy for the police to find a money mule. The money mule is also someone who can provide the police with information about the criminal who used the account. There is a good chance that the money mule knows more about the identity of the criminal.

Civil law (liability)

Money mules can see through their bank account how and where the stolen money has been withdrawn or to which person and bank number the money has been transferred. Victims of scams can claim this information and go to court. This way they can follow the money trail and find the culprit. The money mule is then caught between the victim of the crime and the criminal (who may be dangerous). Victims can start proceedings against a money mule to obtain this information. It is also possible that the money mule is held liable for the total damage, for example due to group liability (Article 6:166 of the Dutch Civil Code).

The relationship between the bank and the money mule

Banks have incident registers in which fraud is recorded. Furthermore, the provision of a bank account is prohibited in the banking conditions. A bank can terminate the relationship with a money mule and the money mule can have problems opening a bank account for a longer period of time. But it also happens that someone is wrongly regarded as a money mule. For example, if a bank card and login details are stolen. The bank can then be forced through the courts to reverse the measures.