A Cypriot CFD broker must repay €807,600 from the District Court of Noord-Holland. The court ruled that there were “unfair commercial practices”.

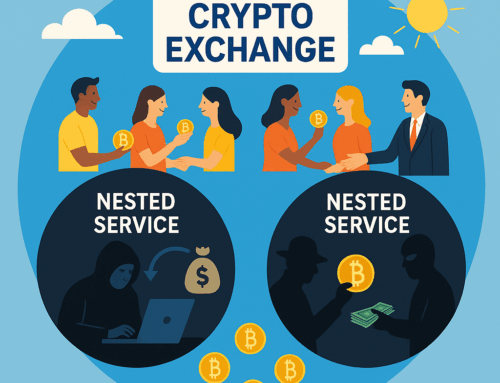

This is the first ruling in a series of proceedings pending before various courts in the Netherlands against CFD brokers from Cyprus. In total, this involves damage of more than € 12 million. Most victims say that they came into contact with the investment products from Cyprus through a “fake ad” with a well-known Dutchman who says that he has earned a lot of money in a short time with bitcoin investments. In reality, the investment goes into Contracts for Difference (CFDs), which are very risky investment products.

Multiple defenses

The broker lay down on several anchors in its defense, but none of the arguments hold up. In a first round, the broker questioned the jurisdiction of the court. According to the fine print of the contract, the case is to be heard by a judge in Cyprus. However, the court declared itself competent; so the strategy of moving the arena to Cyprus is not working.

Applicable law

Another line of defense of the broker is the claim that Cypriot law should be applied. In Cyprus, the European Unfair Commercial Practices Directive has been incorporated into national law in a different way than in the Netherlands. In Cyprus, a consumer can only lodge a complaint with the Consumer Authority; what is not possible is to declare the contract invalid (destroy it), so that the investment must be repaid. This is possible in the Netherlands (Article 6:139j paragraph 3 of the Dutch Civil Code). Under Dutch law, a consumer therefore has a more effective weapon at his disposal, provided that unfair commercial practices are involved. For these reasons, the broker pushed for an assessment under Cypriot law. A problem with this is that under Art. 6 paragraph 4 of the Rome I Regulation Cypriot law applies when it comes to Contracts for Difference, including in consumer matters. In fact, this case is not about the sold CFDs themselves, but about trading around these products, such as the compulsion to make additional deposits if the CFDs are at a loss. Thus, the court applies art. 4 of the Rome II Regulation: it concerns unlawful acts whereby the damage arises in the Netherlands.

Unfair Business Practices

The aggrieved customer has described in detail what the course of events was. The broker recorded all conversations with the client, but did not submit them. The court therefore assumes that the customer’s representation of the facts is correct, even if the broker contradicts these facts. The actual course of events that the court therefore assumes falls under the heading of unfair commercial practices. The court speaks of, among other things, intolerable pressure, lack of professional dedication and coercion.

Professional account

The broker also argued that the client was a professional investor (EPC, elective professional client). A professional investor has less protection than a retail investor. The court does not follow this defense, because the way in which the customer became EPC also falls under the heading of unfair commercial practices.