Suppose you are called to start investing, and it seems like something to you. You look at the website and it looks good. You can start with a low amount and your investments will go well. You get a call again, and you’re tempted to make some more. But you still have doubts, because the company is abroad and you wonder if it isn’t too good to be true. How do you recognize whether you may be dealing with a “boiler room”? In this article we give 9 tips on how to spot an unreliable investment website. Investment fraud is common. It happens to both novice investors and experienced investors who embark on an adventure with CFDs (Contracts for Difference) and Forex products. Here are our tips:

-

The deposit goes to an account in the name of another party

A reliable company receives money in a bank account in its own name. Boilerrooms (criminal websites that suggest that you are investing when you are not) often do not have their own bank account. After all, they don’t want to be caught. That’s why they use money mules . Money mules are people (sometimes companies) who make their bank accounts available for criminal activities. If a financial company gives an “instruction” on how to deposit, and the bank account name is different from the company name, or the account is located in a different country, then you are probably about to lose your money to a gang of scammers (who then quickly divert your money).

-

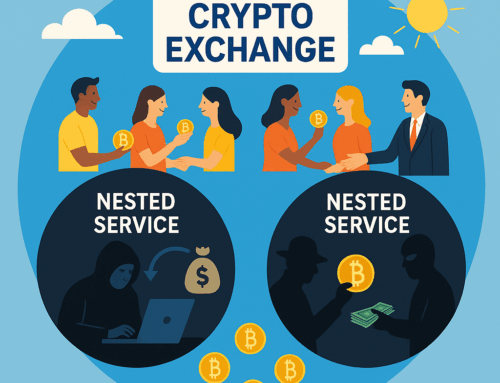

You have to pay the deposit via bitcoins

A variant of this is that an untrustworthy company tells you that deposits can only be deposited by buying bitcoins or other cryptocurrencies via a (reliable) website where you can deposit bitcoins in a wallet. You will then receive a code and pay anonymously with bitcoins. The bitcoins are quickly converted into cashless money, and deposited into the account of a cat catcher that is used to channel the money. Never fall for this. Many people are enthusiastic about cryptocurrencies. But they are also favorite toys of criminals because of their anonymity.

-

It is not clear how money is made

A serious financial company openly explains how it makes money. For example, via an amount per transaction. Boilerrooms often have beautiful websites where you can create a nice (fake) account, but often they are so sloppy that they do not tell you what advantage they have of taking on you as a customer. And that is strange, because a reliable financial company does not mince words. If you cannot find the fee structure or the commission on a website, then you should ask yourself whether business is being done fairly.

-

The employees are not on social media

Almost everyone who works in the financial world these days is on the business networking site Linkedin. And if that is not the case, they are privately on facebook or twitter. Just not criminals, at least not with their real name. If you have contact with a boiler room, you will have to deal with “employees”. They state their first and last names and have a company email address. But yes, you have come up with a nice name in no time, and coming up with an email address is not that difficult. See if these people really exist on social media and search their names on google. Does it make sense to you? Or is there something wrong?

-

The company is located in a tax haven

Some financial company websites and boiler rooms are established by officially existing companies that are based as mailbox companies in a tax haven. The reason for this is that the judiciary in such places is often not reliable. This means that the people behind these clubs cannot be properly tackled with resources that you can deploy in a country where the rule of law functions well. Within the European Union, for example, you can seize bank accounts, a means that lawyers use to recover money for victims. But in tax havens that is difficult or very expensive. Incidentally, there are also countries within the European Union with a bad reputation in this area, such as Cyprus and Malta.

-

The phone number doesn’t make sense

From a legal point of view, boiler rooms are often mailbox companies from a tax haven, but the office where the fraudsters work may actually be right around the corner. Suppose the website states that the office is in London, you would expect to see the UK country code when you get a call. But if you see +49, then you are being called from Germany and not from England. That does not make sense, because then the office is in Germany, while they say they are in England. An indication that you are dealing with fraudsters.

-

Do a “whois” inquiry

Are you still unsure whether your “investment” is safe or whether you are dealing with fraudsters? Then you can check who is the owner of the domain name of the website where your account runs via a whois search on the internet. If that’s a name that is different from the financial company, then something strange is going on. A reliable company owns its domain name itself. A company that has something to hide will use a front man to register the domain name, making it difficult for detectives to figure out who is really behind it. A straw man has been found in no time. For example, a bum who is happy with a few cents. He then has a company to his name….

-

You have to make an additional deposit to withdraw money

Many people who get entangled in a boiler room, at some point want to secure and withdraw a portion of their “profit”. For the boiler room, this is a sign that the victim does not want to invest any more money. The fraudsters then switch to a different tactic. They come up with arguments to make the victim believe that money must first be deposited before money can be withdrawn. An example of such an excuse is that the boiler room has issued a credit on a trade so that a deposit is required. This is all nonsense, but the criminals cleverly capitalize on the victim’s fear of losing their nice profit. They want you to keep depositing. If you’ve come this far, you’ve probably already lost a lot of money, and you’re about to lose money again. Do not.

-

A lawyer calls to get money back

At a certain point the hard truth dawns on a victim. It’s about fraud. At that stage, clever scammers try yet another trick to knock even more money out of the victim’s pocket. They call again and say that they are from a (foreign) law firm or a recovery agency that is tracking the fraudsters on behalf of several clients. What a coincidence, they came across your name as a victim on a list. That list is also known as the “sucker list”. To get money back, you can participate, and then these so-called lawyers will tackle the boiler room. But you have to pay a fee first. Never fall for this. Real law firms never approach clients this way. You are about to fall into the trap again. Even if the so-called law firm has a beautiful website. After all, the boiler room had that too…. anyone can create websites.

You have been duped, now what?

Read more on this topic:

Can you recover the damage from the bank?

Watch the broadcast of Omroep Max about boiler rooms here (in Dutch).